The Russian invasion of Ukraine is obviously bringing tensions in the energy market due to the well-known role of gas metals such as gold and pipelines from Russia crossing Ukraine.

Agriculture products such as Ukrainian and Russian wheat, sunflower, and corn are expected to see an increase in price due to loading problems in the black sea.

Relatively for metals, the Russian Federation is not only a strong exporter of Palladium mainly used in the automobile industry, but also an exporter of Titanium used in the aeronautical industry, nickel, and aluminum. A price increase is therefore expected in both scenarios.

An embargo to the Russian Federation or, from the other side, a restriction of exportations from Russia to the EU will affect the prices.

What about gold? Scientific usage of gold, mostly for thin film and evaporation applications (contacts for semiconductors, nanoparticles, aerospace coatings) represents a very small percentage of industrial usage.

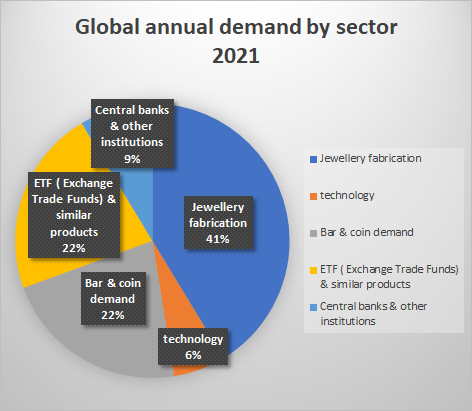

Jewelry represents about 50% of total demand; even though there has been a slight decrease in this demand mainly due to covid as the Indian and Chinese markets are compensating for global decline.

Investment demand of gold has increased up to 235% over the last three decades.

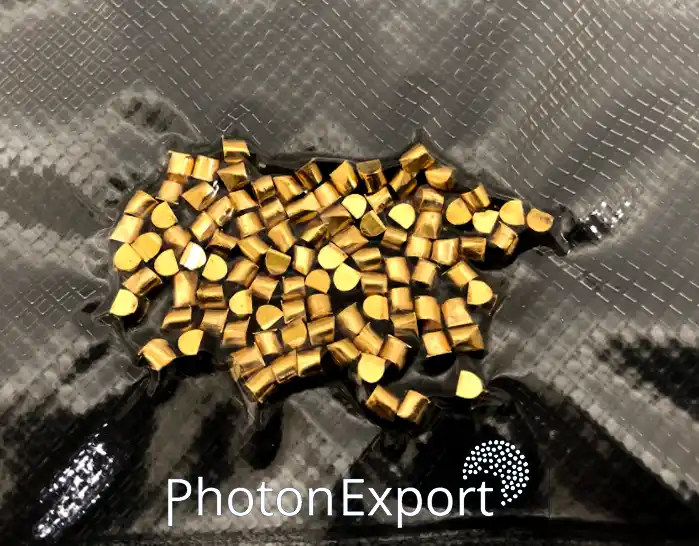

FROM PHOTONEXPORT WE WORK ON THE RECYCLING OF GOLS, such as TARGETS, THIN FILMS OR GRANULES

1Gold Market

The global market is expected to represent $189.6 billion by 2022 (*BCC research) but according to our calculations based on global demand, the current price for the 2022 market is expected to be more than $260 billion.

Gold global demand 2019-2021[1]

Sector / Demand in M of Tones 2019 2020 2021 Delta 21-20 Delta 21-19 Jewelry fabrication 2137,72 1327,43 2220,95 67% 4% technology 325,96 302,76 330,16 9% 1% Bar & coin demand 866,66 899,65 1180,37 31% 36% ETF ( Exchange Trade Funds) & similar products 408,21 874 1180,37 35% 189% Central banks & other institutions 605,41 254,95 463,07 82% -24%

2 Which factors are impacting the price of gold:

Contrary to the traditional metals, the equilibrium among offer and demand is not the main price evolution factor for gold.

Indeed, gold’s value is closed to a currency value, speaking in monetary terms.

The price of gold depends on its symbolic exchange value: this historical role is today materialized mainly through central banks stocks that constitute important reserves for exchange.

The value of this movement of gold depends more on the macroeconomics conditions than the actual physical demand. Gold prices are directly influenced by the macroeconomy, which is in turn directly influenced by the geopolitical situations such as the current Ukraine Invasion.

Gold is directly indexed on the American dollar, fluctuations of which will affect gold’s market price. Therefore, USA inflation, USA FED interest rates, and currency exchange rate are factors that will affect the price of gold, which has traditionally fluctuated in the opposite direction of dollar value.

2.1 Gold and ETFs:

The recent phenomenon of investment funds associated with gold: ETF (Exchange Trade Fund indexed to gold price) adds to the complexity of gold price formation. ETF, like other types of funds, is subject to speculation. ETF has confirmed that gold has entirely become a fully financial asset

2.2 Gold’s correlation with energy: possibility of an inflation

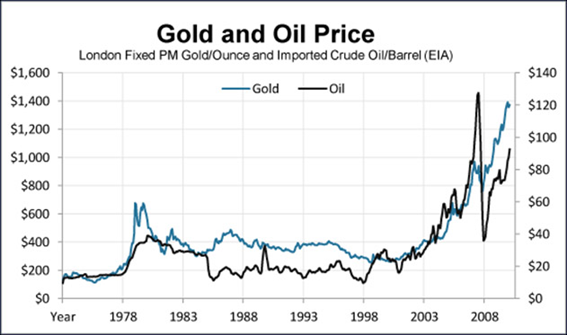

There is a high correlation between gold and oil prices at around 85%.

However, the study showed the relationship between the gold price growth and cumulative inflation was around 9% over the last four decades and that there was no significant relationship between the gold price and inflation´s index. This shows that the range of gold prices to oil prices remains stable over the long term.

2.3 Gold as a commodity

The behavior of the prices of historical commodities includes three different components: long-term reversion, diffusion, and jump/dip diffusion. Shahriar Shafiee and Erkan Topal proposed a model in 2008 that was validated with historical gold prices.

The model was then applied to forecast the price of gold for the next 10 years. The results indicated, with the assumption that the current price jump initiated in 2007 behaves in the same manner as that experienced in 1978, the gold price would stay abnormally high up to the end of 2014.

After that, the price would revert to the long-term trend until 2018.[2]

2.4 Offer and demand: gold production

China became the world’s leading producer of gold in 2007 beating South Africa (280.5 tons compared to 270 in South Africa).

However, no Chinese mine is among the largest known deposits in the world and the first Chinese company in the producer ranking is only the 12th (China National Gold Group, www.chinagoldgroup.com).

Despite the exponential growth in Chinese gold production, there is no reliable data about the exact figures as most of the production is destined to the local market.

Moreover, China is also among the top gold importers, both for central bank stocks that have been steadily increasing since 2009 and for private consumption.

The market complexity of gold goes further as there is a geographical decorrelation between primary production and the manufacture of high-value-added products.

Gold alloys that result from its production are at a maximum of 85-90% purity. Gold refinery process, leading to “bullion”, wafers, or gold for technological application is at a standard purity of 99.99% (or even at 5N purity) and is concentrated on three main platforms: Switzerland, Dubai, and Hong Kong.

3 Conclusion: incertitude -> volatility more than increase

To conclude, it can be said that the incertitude in the current geopolitical situation of the world will tend to increase the gold price as it is one of the main safe-haven assets.

But more volatility is expected rather than a simple increase as the current situation is unique and a lot of monetary measures might occur due to the war. This might lead to mitigated increased in the price of gold.

As per EU Central Bank President Christine Lagarde’s 25th February announcement: “The ECB stands ready to take whatever action is needed to fulfil its responsibilities to ensure price stability and financial stability in the euro area.”[3].

For technology application like gold PVD evaporation for microelectronics and nanothecnhoology, recycling gold or other precious metal is possible with PhotonExport, this will reduce the impact on gold prices fluctuations.

[1] Metals Focus, World Gold Council;*Data to 31 December 2021. [2] An overview of global gold market and gold price forecasting-Shahriar Shafiee (a), Erkan Topal (b)

(a)School of Mining Engineering, Frank White Building (#43), Cooper Road, CRC Mining, University of Queensland, St. Lucia, QLD 4072, Australia

(b)Mining Engineering Department, Western Australian School of Mines, Curtin University of Technology, Kalgoorlie, WA 6433 Australia

[3] https://www.ecb.europa.eu/press/pr/date/2022/html/ecb.pr220225~2b6548f7d9.en.html